- WristCheck

- Posts

- Rolex vs S&P500 💹

Rolex vs S&P500 💹

What would the better investment have been? Huge ROI and a definite winner!

An Investment Guide on the Price of an Average Rolex Watch in Comparison to the S&P 500

Introduction

First of all, please note that this is done striclty for interest’s sake and is by no means an investment guideline or financial education. To truly compare the two you would have to do a comprehensive analysis on all Rolex watches and even then it is hard to put them head to head. That being said, for a little bit of light-hearted fun, let’s get this battle underway…

Investors are always looking for ways to maximize their returns. Whether it's through the stock market or alternative investments, the goal is to earn the most money with the least amount of risk. One investment option that many people consider is luxury watches, such as Rolex. In this guide, we will explore the price of an average Rolex watch in comparison to the S&P 500 and discuss the benefits and risks involved in investing in a luxury watch.

Exploring Historical Price Data of Both Rolex and S&P500

When considering an investment, it's important to look at historical price data. The same is true for Rolex watches and the stock market. According to the Rolex Stock Index, the price of an average Rolex watch has seen a steady increase over the years. However, it's important to note that not all Rolex watches are created equal. The price of a Rolex watch can vary greatly depending on the model and condition of the watch.

On the other hand, the S&P 500 has also seen significant growth over the years. In fact, the S&P 500 has historically provided an average annual return of around 10%. However, it's important to remember that past performance does not guarantee future results. The stock market is unpredictable and can be affected by a variety of factors, including economic conditions and political events.

The Benefits of Investing in a Rolex Watch vs. Investing in the Stock Market

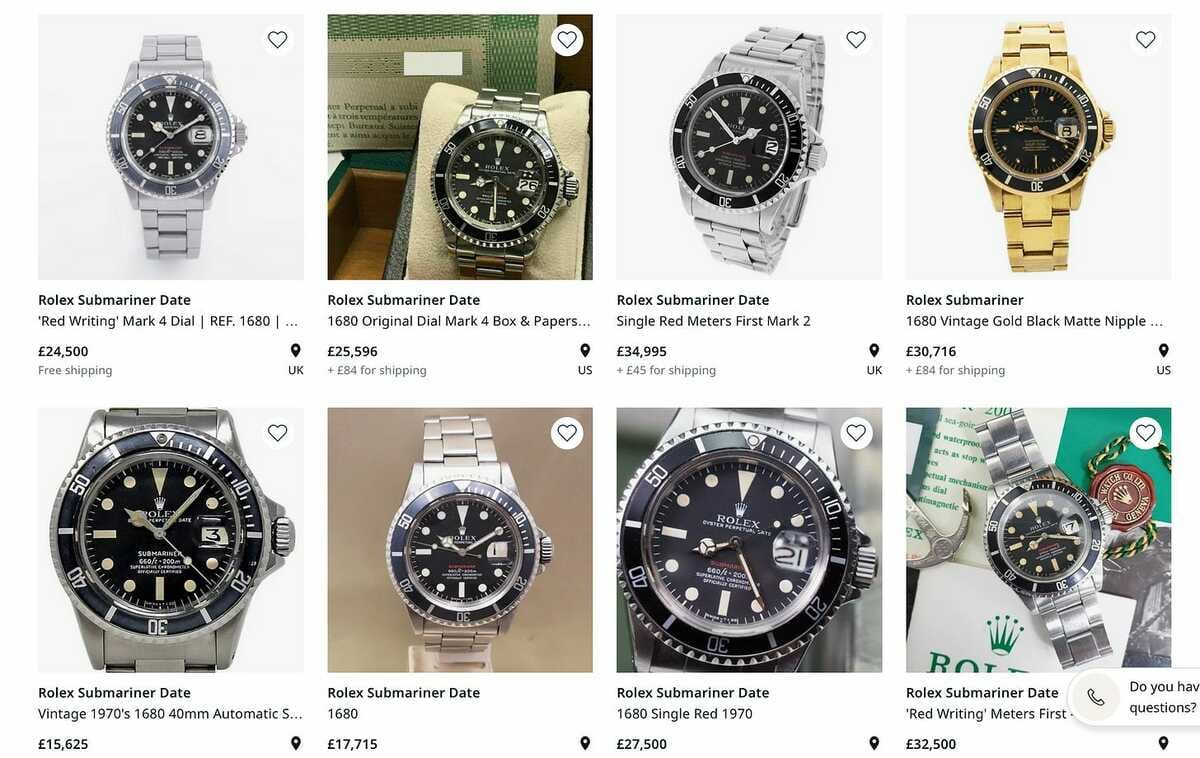

One benefit of investing in a luxury watch such as Rolex is that it can provide a tangible asset that can be enjoyed and used on a daily basis. A luxury watch can also be a status symbol and a conversation starter. However, it's important to remember that luxury watch investments come with their own set of risks. Luxury watches can be expensive to maintain and repair, and the value of a watch can depreciate over time. The average price for most Rolex watches falls between $7,000 – $12,000 MSRP. However in this example we will look at the Submariner, which starts at a price of $8950. More specifically at the ref. 1680.

Investing in the stock market, on the other hand, can provide a more diversified portfolio and potentially higher returns. The stock market can also be more liquid, allowing investors to quickly buy and sell their investments. However, investing in the stock market also comes with its own set of risks, including market volatility and the potential for significant losses.

What would’ve the best investment have been?

Rolex Submariner ref. 1680 vs S&P500.

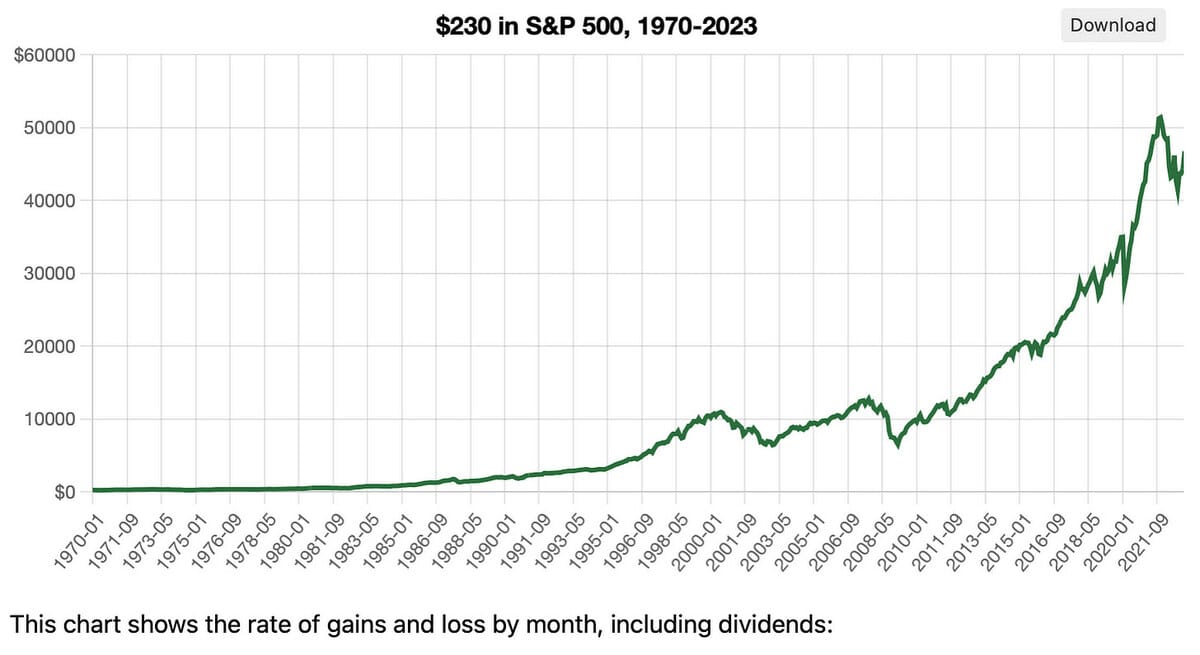

In the early 1970’s, a Rolex Submariner would be ±$230. We’re going to take a look at whether buying a Rolex in 1970 or investing that $230 in the S&P500 index fund wouldve brought more returns.

Rolex

After looking at the Submariner ref. 1680 on Chrono24 we can see that the average price of the ref. 1680 is roughly £24,000 or $28,800 (as of 06/03/2023). This is a total ROI of 12,421.74% and an annulised ROI of 16.29%.

S&P500

If you invested $230 in the S&P 500 at the beginning of 1970, you would have about $46,744.80 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 20,223.83%, or 10.53% per year.

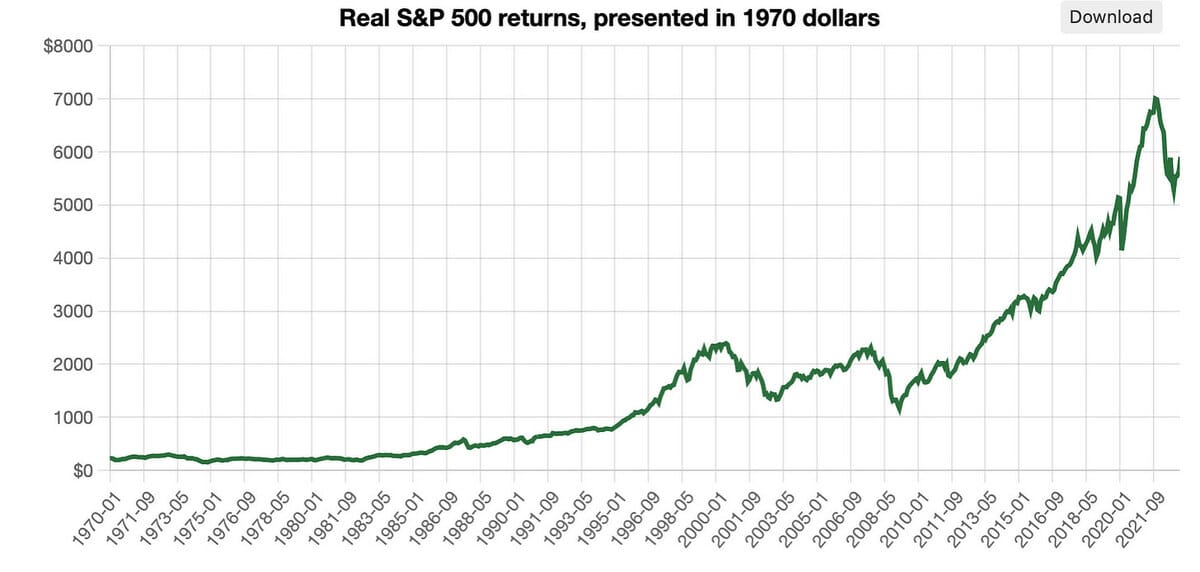

However, it's important to take into account the effect of inflation when considering an investment and especially a long-term investment. You can convert S&P returns to their real (inflation-adjusted) value using an inflation calculation based on the U.S. Bureau of Labor Statistics Consumer Price Index (CPI).

In the case of the returns described above, the CPI in 1970 was 38.800 and the CPI in 2023 was 299.170.

The ratio between these CPIs describes how relative buying power of a dollar has changed over 53 years.

Adjusted for inflation, the $46,744.80 nominal end value of the original $230 investment would have a real return of roughly $5,832.43 in 1970 dollars. This means the inflation-adjusted return is 2,535.84%as opposed to the original 20,223.83%.

Conclusion

In conclusion, investing in a luxury watch such as Rolex can be a viable investment option for some investors. However, it's important to weigh the benefits and risks before making any investment decision. While historical price data can be helpful, it's important to remember that past performance does not guarantee future results. Whether investing in a luxury watch or the stock market, it's important to consider all factors and make an informed decision.

As stated in the introduction: this was done striclty for interest’s sake and is by no means an investment guideline or financial education.